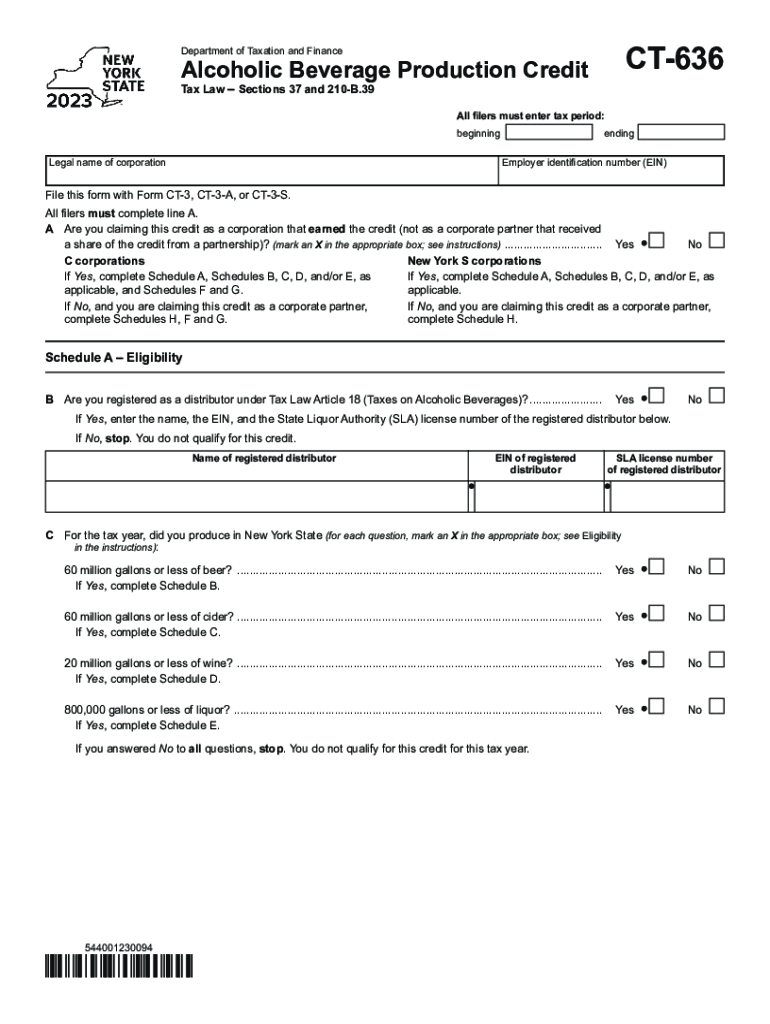

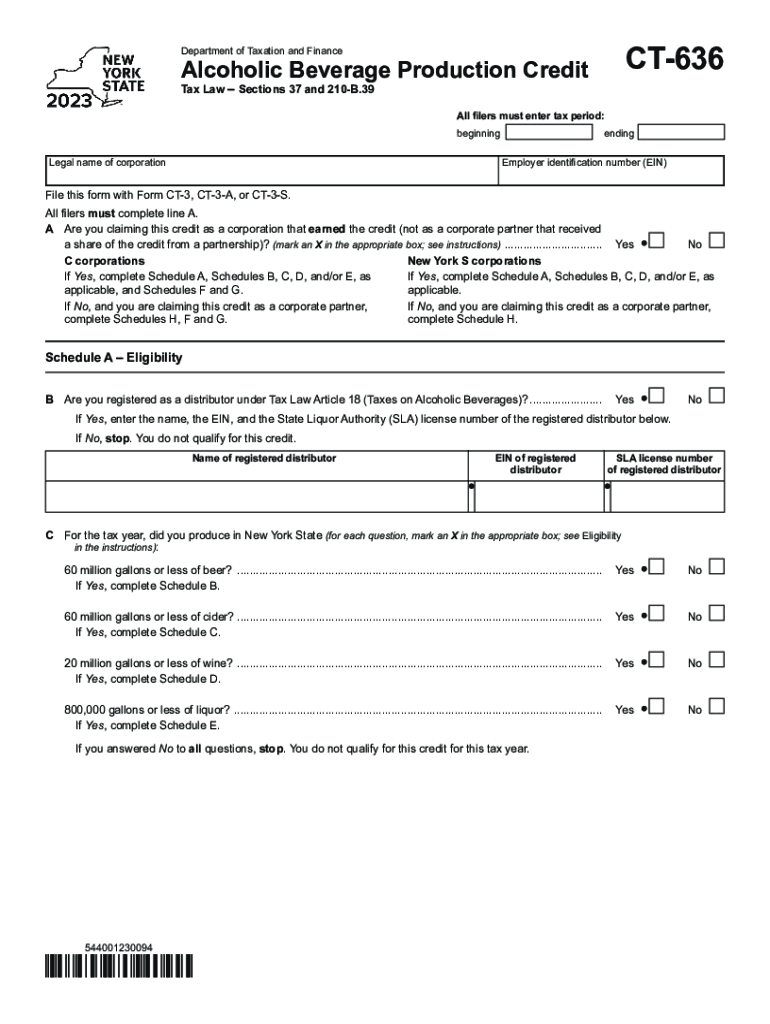

NY DTF CT-636 2023-2024 free printable template

Show details

Credit to be used this tax year. Unused tax credit available as a refund or as an overpayment subtract line 41 from line 35. 800 000 gallons or less of liquor. If you answered No to all questions stop. You do not qualify for this credit for this tax year. If No stop. You do not qualify for this credit. Name of registered distributor EIN of registered distributor SLA license number of registered distributor C For the tax year did you produce in New York State for each question mark an X in the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax corporation 2023-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax corporation 2023-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax corporation online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax filed form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NY DTF CT-636 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax corporation 2023-2024 form

How to fill out tax corporation

01

To fill out form CT-636 alcoholic beverage, follow these steps:

02

Download the form CT-636 from the official website of the tax department.

03

Read the instructions carefully to understand the requirements and guidelines for filling out the form.

04

Provide your business information such as name, address, and contact details in the designated fields.

05

Include the relevant tax identification number and fiscal year for the report.

06

Enter the total amount of alcoholic beverages distributed or sold during the reporting period.

07

Provide detailed information about the type, quantity, and value of the alcoholic beverages in the specified sections of the form.

08

Calculate and enter the total tax liability based on the provided information.

09

Review the form for accuracy and make sure all sections are properly filled out.

10

Sign and date the form.

11

Submit the completed form CT-636 to the appropriate tax department.

Who needs tax corporation?

01

Any business entity involved in the distribution or sale of alcoholic beverages in the relevant jurisdiction needs to fill out form CT-636 alcoholic beverage. This includes liquor stores, bars, restaurants, wholesalers, and any other business dealing with alcoholic beverages.

Video instructions and help with filling out and completing tax corporation

Instructions and Help about jointly irs filing form

Fill tax return corporation : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form ct-636 alcoholic beverage?

Form CT-636 Alcoholic Beverage is a tax return form used by businesses that sell alcoholic beverages in the state of Connecticut to report and remit the specific alcoholic beverage tax.

Who is required to file form ct-636 alcoholic beverage?

Businesses that sell alcoholic beverages in the state of Connecticut are required to file Form CT-636 Alcoholic Beverage.

How to fill out form ct-636 alcoholic beverage?

To fill out Form CT-636 Alcoholic Beverage, businesses need to provide information such as the total sales of alcoholic beverages, the specific alcoholic beverage tax due, and any deductions or credits that apply.

What is the purpose of form ct-636 alcoholic beverage?

The purpose of Form CT-636 Alcoholic Beverage is to report and remit the specific alcoholic beverage tax to the state of Connecticut.

What information must be reported on form ct-636 alcoholic beverage?

Information that must be reported on Form CT-636 Alcoholic Beverage includes total sales of alcoholic beverages, the specific alcoholic beverage tax due, and any deductions or credits that apply.

When is the deadline to file form ct-636 alcoholic beverage in 2023?

The deadline to file Form CT-636 Alcoholic Beverage in 2023 is typically the last day of the month following the end of the quarter. Specific dates may vary, so businesses are advised to consult the official guidance or their tax advisor for the exact deadline.

What is the penalty for the late filing of form ct-636 alcoholic beverage?

The penalty for the late filing of Form CT-636 Alcoholic Beverage may vary depending on the specific circumstances. Businesses may be subject to penalties and interest charges for late or non-filing. It is recommended to refer to the official guidance or consult a tax advisor for details on the penalties.

How do I modify my tax corporation in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tax filed form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find ct 636?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the return file in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit jointly filing on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tax return filed form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your tax corporation 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 636 is not the form you're looking for?Search for another form here.

Keywords relevant to nys ct 636 form

Related to return joint file

If you believe that this page should be taken down, please follow our DMCA take down process

here

.